National Pension Fund Scheme (NPS)

The National Pension System (NPS) is a government-backed retirement savings scheme designed to promote

financial security during one’s working years. It encourages individuals to contribute regularly throughout

their careers, helping them build a substantial retirement corpus over time.

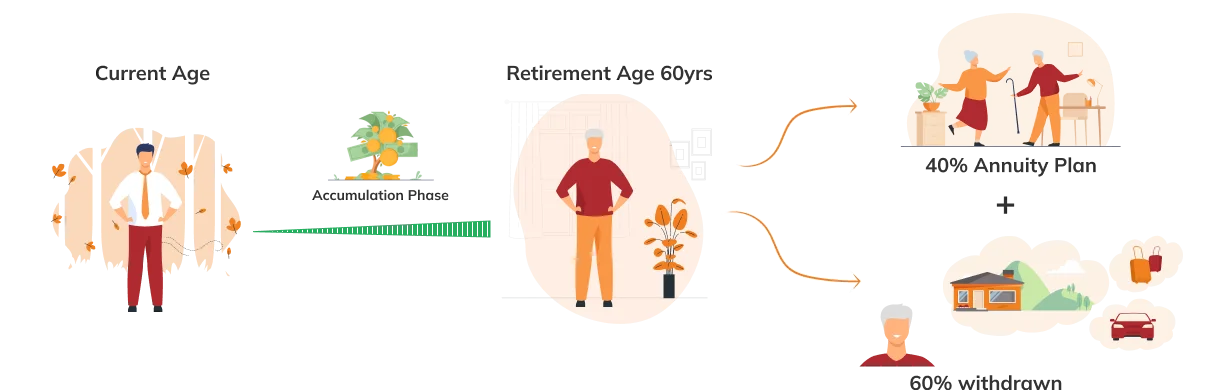

At the time of retirement, NPS provides a mix of lump sum withdrawals and regular pension income, offering long-term financial stability. Regulated by the Pension Fund Regulatory and Development Authority (PFRDA), the scheme ensures transparency, accountability, and trust in its operations. With its structured approach, NPS serves as a reliable and efficient solution for planning a comfortable retirement.

Discover Our Insurance

Services For All

Who Should Invest in the NPS?

The National Pension System (NPS) is a great choice for individuals aiming to plan their retirement early with a low-risk strategy. By making regular contributions, you can build a reliable income stream and ensure financial stability during your retirement years.

For salaried individuals seeking to optimise tax savings under Section 80C, NPS is a smart addition to your investment portfolio. Designed for long-term growth and consistent returns, the scheme provides confidence and security for your financial future. To learn more, explore the NPS pension scheme and open your NPS account online today.

Types of NPS Accounts & Contributions

The National Pension System (NPS) offers two types of accounts: Tier 1 (mandatory) and Tier 2 (voluntary). A Tier II account requires a Tier I account and differs in tax benefits and withdrawal rules.

- Tier 1 Account: Government employees contribute 10% of their base pay plus DA, while others invest a minimum of Rs. 500 initially and Rs. 6,000 annually.

- Tier 2 Account: Does not offer tax breaks or matching contributions but allows flexible withdrawals anytime. Opening a Tier II account requires an initial payment of Rs. 1,000 and subsequent top-ups of Rs. 250, maintaining a yearly balance over Rs. 2,000.

25

Years Experience

in This Field

Benefits of NPS Account.

- Low Cost:- NPS is considered to be the world’s lowest cost pension scheme. Administrative charges and fund management fee are also lowest.

- Simple:- All applicant has to do is to open an account with any one of the POPs being run through all DMCCS Offices across India and get a Permanent Retirement Account Number(PRAN)

- Flexible:- Applicant can choose his/her own investment option and Pension Fund or select Auto choice to get better returns.

The best PENSION SCHEME for retirement planning.